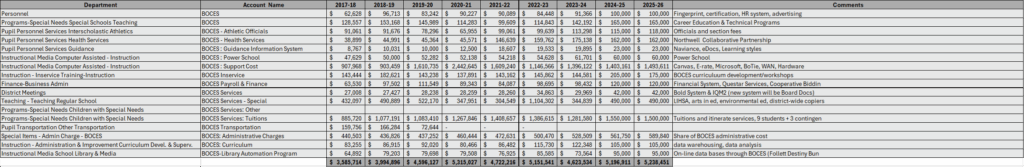

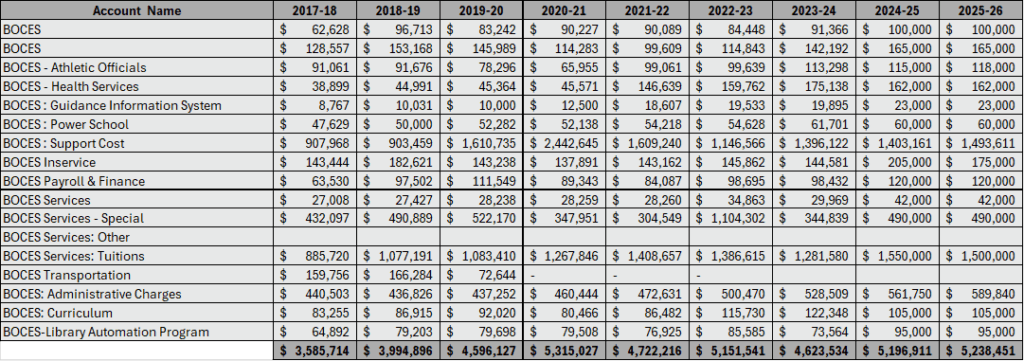

In 2014, Long Island Business News warned: “BOCES no bargain for LI taxpayers.” A decade later, Jericho’s numbers point the same way. Our BOCES bill has climbed almost 50% in nine years—rising from $3.6M in 2017–18 to $5.2M in 2025–26—an annual growth rate near 5%, roughly triple the pace of the overall district budget.

What State Law Requires (and What It Doesn’t)

New York State created BOCES to let districts share services. Two tracks matter here:

- Optional services: Districts choose whether to buy programs (special ed classes, CTE, tech/PD, etc.). If districts don’t buy, those programs can be scaled back or shut down.

- Mandatory apportionment: Separate from programs, districts are apportioned BOCES Administrative Charges—Administrative Operations, Facilities Rental, and Capital Projects & Debt Service—on a per-pupil (RWADA) basis. Even if a district buys no services, this apportionment still arrives each year.

Each April, local boards vote on BOCES’s Administrative Operations budget. A majority “no” forces a contingency admin budget (basically capped), but it does not erase the apportionment.

Paying for Two Bureaucracies

Nassau BOCES plans to bill districts $34.7M in 2025–26 Administrative Charges—assessed by RWADA regardless of how much a district uses BOCES. Jericho’s mandatory share is about $560,000 this year.

Meanwhile, Jericho already pays its own administrators and staff to run curriculum, technology, HR, special education, communications, and operations. Then we pay again for BOCES to run parallel versions of the same functions—plus retiree benefits and central office overhead at BOCES. That’s paying twice.

The BOCES “Aid” Trap

Supporters point to “BOCES Aid.” Yes, Jericho receives state aid when purchases run through BOCES. But aid flows only if we buy through BOCES—discouraging direct-to-vendor competition. The public never sees the line-by-line, unit-by-unit comparison that proves BOCES is cheaper on a true-net basis once overhead and surcharges are included. Without competitive context, “aid” becomes a justification, not a result.

The Black Box: Where’s the Detail?

Nassau BOCES’s 2025–26 plan is enormous: $532.8M in total—$227.8M for Special Education (up 5.3%), $188.4M for Curriculum/Instruction/Technology, $54.2M for Career & Technical Education (up 4.3%), and $20.1M for Transportation (up 8.2%). But residents don’t see what those dollars buy for Jericho. There’s no service-level detail, per-license pricing, per-student costs, or unbundled overhead.

What we do see in the Jericho budget is a single blob: “BOCES.”

What Jericho Actually Pays For (The Part You Don’t See in the Budget Book)

Here is the district’s own BOCES detail—the items taxpayers don’t see in the public packet. It includes BOCES charges for HR/fingerprinting/ads, PowerSchool and data systems, curriculum and in-service PD, finance/payroll services, athletic officials, health services, guidance systems, library automation, special-education tuitions, and the big one: BOCES Administrative Charges.

Where We Pay Twice (Obvious Overlaps)

| Function / Category | Jericho In-House Staff / Contracts | BOCES Services Billed to Jericho | Result for Taxpayers |

|---|---|---|---|

| Technology & Data | Tech director, IT staff, Canvas/PowerSchool licenses | PowerSchool support, data warehousing, library automation | Pay district tech and BOCES tech. |

| HR & Payroll | Asst. Superintendent for HR, payroll/benefits staff | BOCES Payroll & Finance; Personnel (certification, fingerprinting, OLAS) | Duplicate HR/payroll structures. |

| Curriculum & Training | Curriculum directors, coaches, PD budgets | BOCES Curriculum; Inservice training; regional workshops | District PD and BOCES consultants. |

| Communications | District communications director | BOCES communications office, PR/consultants/freelancers | Two PR departments. |

| Special Education | CSE, psychologists, special-ed staff, aides | BOCES special-ed tuitions and related services | In-house plus BOCES placements. |

| Transportation | $5.4M contract with First Student | Share of BOCES’s $20.1M transportation operation (RWADA-billed) | Two systems—vendor and BOCES division. |

These aren’t efficiencies; they’re redundancies. The district hires people to do the work, and BOCES bills us again to cover its staff doing the same categories of work.

Follow the Money (In Plain English)

- Yes—BOCES has spendable money on hand. The FY 2024 audit shows governmental funds took in about $567.3M and spent $533.0M, a fund-basis surplus of ~$34.3M. Total governmental fund balance ended around $116.7M.

- Yes—BOCES earns investment income. FY 2024 interest/earnings were roughly $19M.

- Yes—surplus is redeployed. FY 2024 schedules show a current-year surplus and transfers of about $17.8M to the Capital Fund, $3.0M to a Retirement Contribution Reserve, and $575k to a CTE Equipment Reserve.

- Why the audit also shows a big negative “net position.” The government-wide (accrual) statements book long-term liabilities—especially retiree health (OPEB)—which makes the unrestricted net position look deeply negative. That doesn’t change the fund picture: BOCES still held significant spendable resources and earned interest last year.

Translation: BOCES has no taxing power, but it does build fund balance, earns interest, and moves prior-year surpluses into capital and reserves. It’s not a break-even charity—it’s a large public enterprise that disperses its overhead across 56 districts.

Capital & Debt: Are We Paying That Too?

Yes—partly, via RWADA. BOCES’s Administrative Charges explicitly include Facilities Rental and Capital Projects & Debt Service along with Administrative Operations; the total is assessed to districts through RWADA. Separately, BOCES funds its Capital Fund with agency surpluses (e.g., $17.0M transferred in 2025–26) and other revenues. This is further reason to insist on line-item transparency before approving any bill.

Call the Machine What It Is

BOCES has no taxing authority, but it sustains itself on district program purchases, RWADA-billed administrative/facilities/capital charges, interest income, and retained surpluses. Without line-item transparency and competitive analysis, taxpayers cannot verify “savings.”

Action Items for the Board of Education and Administration

- Require BOCES attendance. Invite Nassau BOCES leadership to a budget workshop to present and publicly justify every line Jericho pays.

- Publish a BOCES line-item sheet. Post a simple “Schedule A” with the budget materials: service name, account code, vendor-of-origin (if BOCES is a pass-through), unit counts, unit prices, any overhead component, aid impact, and the total billed to Jericho.

- Set a transparency deadline. Release all BOCES materials at least 21 days before the meeting so the community can review them.

- Hold a public Q&A. Dedicate time for BOCES to explain the Administrative Charge, RWADA formula, and Jericho’s five-year trend, then take questions from residents.

- Demand competitive context. For any BOCES line over $25,000, require a side-by-side comparison to a direct-to-vendor quote so taxpayers can see real net value.

- Show utilization and outcomes. For each purchase, publish who used it (students/staff/licenses), service levels (uptime/response), and deliverables.

- No materials, no approval. If BOCES doesn’t deliver the requested detail, table the item until it does.

The Bottom Line

Jericho taxpayers are locked into a system that forces us to:

- Pay for our own administrators.

- Pay again for BOCES administrators and retirees.

- Fund capital/debt service and facilities rent via RWADA.

- Write checks without service-level transparency or market comparisons.

Until we see line-by-line pricing and competitive alternatives, BOCES is exactly what LIBN said ten years ago: no bargain for taxpayers.